Jump straight to the book, or…

Sometimes people ask me how much money they need in order to begin financial trading.

In a regular stockbroker share dealing account it’s quite a lot, because you probably need to “invest” at least £1000 in any one share in order to overcome the fixed buying and selling fees of (let’s say) £10 each way. Those round-trip fees would account for a massive 8% loss on a much smaller £250 “investment” before the share price even moved, and we’ve not even accounted for the bid-ask spread plus Stamp Duty Reserve Tax (SDRT). So — if you need to allocate at least £1000 to each investment, and you really need at least ten of them for diversification reasons, then you probably need at least £10,000 to get started in a regular stockbroker account.

In a spread betting account it’s different because you don’t pay dealing fees nor SDRT. Because spread bet positions are leveraged, you get a lot more bang for your buck, so it is perfectly possible to diversify a very modest £1000 across ten or (many) more equity positions; or, to allocate a small percentage of your trading capital to any one serial trade without getting eaten by fixed dealing fees.

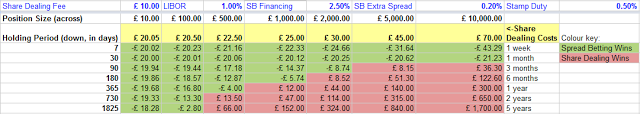

Here is an example of a share dealing / spread betting cost comparison that I did in my new Better Spread Betting book:

When trading a small fund of just £1000, spread betting with one of these companies is almost certainly preferable to share dealing with a stockbroker. You just need to beware that £1000 deposited with a spread betting company might give you a much higher leverage risk of £10,000 or more, so you need to manage the risk using stop orders unless you have the additional £9,000 stashed away somewhere to make good if it all goes wrong!