Jump straight to the book on Amazon, or…

In the Better Spread Betting book I talk about how some spread betting brands such as Capital Spreads and InterTrader allow you to guarantee your stops orders retrospectively, whereas other spread betting companies don’t. Here is a concrete example:

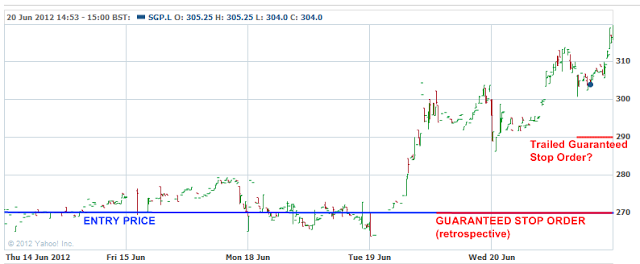

On 14 June 2012 I opened a long spread bet on Supergroup at a price of 270.9 with a non-guaranteed stop order at 260. By 19 June the price of Supergroup shares had risen sufficiently for me to trail my stop order to just better than break-even at 272, and at the same time to guarantee the stop order (retrospectively) for an additional charge of £2.71. In a nutshell: in my Capital Spreads or InterTrader account I didn’t have to pay for my guaranteed stop order until I could place it at the level I wanted it. At the time of writing on the evening of 20 June, the price has risen yet further thereby allowing me to trail my newly-guaranteed stop order to 291 if I so choose. As a picture, the trade I just described looks like this: