I don’t usually day trade, but this morning I was simply too tempted to try and get a quick profit out of Standard Chartered, the bank that was accused of money laundering for Iran.

I heard on the morning news that the shares had fallen overnight in Hong Kong, so I knew they would fall in London at the open. I also knew that there was no way to get in before the fall; so the only way to benefit from the fall would be to bet on the rebound.

A Tale of Three Day Trades

I tried this day trade not once, but thrice. That is, in three different spread betting accounts, although in one of them there were two trades which I’m counting as one. It played out differently in each account, so here is my tales of three day trades.

Day Trade #1: How Not To Trade

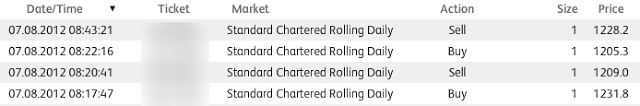

I’m not stupid enough to buy in during the very first minute, because experience tells me that the initial gap-down won’t be the end of it. So I waited for the opening gapped-down price of about 1284 to fall 50 points further to 1231.8, thus saving myself from 50 points (or pounds) of pain. And I was still wrong, because the price just kept on falling to stop me out for a loss of £22.80 at 1209. I re-bought at 1205.3 (which was lower than my last selling price, at least) and I managed to ride the subsequent up-trend until I accumulated just enough profit to break-even overall. The two round-trip trades are shown here:

The following account transactions show how I came out of this close shave with a profit of £0.10.

In this particular case I got an lucky result on a bad trade. I had entered the first trade too soon, I entered the second trade to try and “get even” (though at a good price), and I exited with a sigh of relief as soon as I could do so for no loss. My profit — what profit? — was far lower than the risk I had taken.

Day Trade #2: Close, But No Cigar

In a different spread betting account the trade went a bit better, as you can see here:

The only reason it went better was because the initial stop order on this even-earlier trade was wider than on the trade documented above, so I managed to hang in there rather than getting out and then in again. I took the £5 profit — still disproportionately small compared with my initial risk — when I realised that this account had too wide a minimum stop distance for me to simply “lock in” the accrued profit. So a little bit better, but not great.

Day Trade #3: That’s The Way To Do It!

In yet another account the trade went much better as shown in the following transcript. I caught the price nicely at a bottomed-out 1189.8 and rode it all the way up to 1215 before my trailed stop order stopped me out.

While I could have closed the trade for a peak profit of about £50, I had to settle for a stopped-out profit of just over £25 as shown below. Still, in terms of risk and reward (my initial stop order was very tight giving little risk), this was the way to do it, and it wasn’t a bad result for an hours work.

By the way, if you think you recognise any of the screenshots used in these examples, I can tell you that one set is from Capital Spreads, one is from sister company Tradefair, and the other set is from SpreadEx.

Conclusion

Overall I took a profit of £30.20 across the three accounts. Like I said, it’s not bad for an hours work, but there was more luck than judgement.

My first conclusion therefore is that I really don’t like day trading with the high risk of trading a high-priced (4 digits) volatile stock in a relatively small account. It’s too stressful, and — as the first trade showed — there is too much temptation to close out for emotional relief when back at break-even. It was fortunate, though, that I did so.

My second conclusion is that I did right to close out the first two trades for little or not profit, and that my trailed stop order did its job well to stop me out at 1215 on the third trade — because the price fell to a much lower 1090 later in the day. But then it rose back up to 1225 by close-of-play, meaning that I needn’t have stopped out at all.The bottom line is that overall I achieved an acceptable result (i.e. some profit) for many of the wrong reasons. Never say never, but I find longer-term position trading of embryonic but growing positions to be much more relaxing.

Disclaimer: this posting is for general education only; it is not trading advice.