As it’s the last day of 2012, this “Trade of The Week” feature might be better titled “Trade of The Year”, but I’ll stick with the usual title so as not to confuse you into thinking it was the best trade of the whole year. And in fact it’s two trades, not one.

Readers of my Position Trading book will know that one of the seven pillars of position trading (or at least my interpretation of it) is pyramiding. In a nutshell, it means recycling accumulated profits — for example those “locked in” on existing positions using stop orders — into already profitable positions (usually the same ones).

Here are two recent examples:

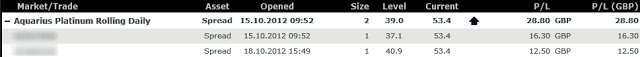

Pyramid Trade #1 on Aquarius Platinum

The following InterTrader chart shows that this stock was bought originally at 37.1p-per-share and then pyramided at 40.9p-per-share. The higher thicker line indicates a guaranteed stop order at 44.8 that ensures a profitable exit for both positions… guaranteed! The rationale for trading this stock in the first place was that — on a longer timescale — the rock-bottom price was bumping along the bottom.

Pyramid Trade #2 on Barratt

The rationale for entering this stock was rather different. You should just about be able to make out on this Capital Spreads chart that the price dipped in mid-September, to a price that corresponded with a possible resistance level towards the beginning of the chart. The original entry was at 160.2p-per-share, and the subsequent pyramid entry was at 196.6p-per-share. On this one, the mutual guaranteed stop order at 190.8 assures a profit on the first position that is much greater than the potential loss on the second position… so an overall net profit is assured.

Proof of the Pudding

I know that readers of trading blogs and books can be sceptical (and rightly so) that these trades are discovered only in hindsight, so here are a couple of screenshots to show that they are real:

Happy New Year!

Two Steps to Better Spread Betting:

1) Buy the Better Spread Betting Book

2) Sign up with Capital Spreads, IG, ETX Capital, or Spread Co

Disclaimer: this posting is for general education only; it is not trading advice.