What a pity I missed out on today’s (14 March 2013) surge in the price of Ocado shares, and the related (but possibly short-lived) boost to the Morrisons share price following the announcement of a tie-up.

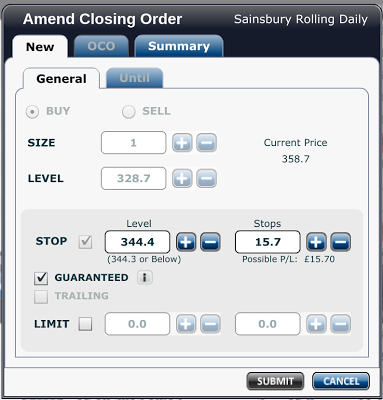

Fortunately, I have had my fingers in another supermarket pie, metaphorically. I’m talking about Sainsburys which has been on something of a roll (not the sausage variety) recently. Okay, enough of the supermarket puns. The following InterTrader order ticket shows a position that was opened at 328.7p-per-share, which is currently sitting on a £30 profit and which has more than half of that profit “locked in” absolutely with a guaranteed stop order.

It gets better, because in another spread betting account I have a double-size position riding on Sainsburys, which resulted from “averaging down” as shown here:

In this case the cardinal sin of “averaging down” worked to my advantage because I notched up a higher profit on the second position than I did on the original position, and now both positions are guaranteed to exit with some profit thanks to the guaranteed stop order(s).

I know this isn’t exactly trading millions, but for the new spread bettors who are likely to tune into this blog– making small amounts of money consistently may be better than losing a large amount of money in spectacular fashion. Or, to put it another way…

“Turnover is vanity, but profit is sanity!”

Two Steps to Better Spread Betting:

1) Buy the Better Spread Betting Book

2) Sign up with Capital Spreads, IG, ETX Capital, or Spread Co

Disclaimer: this posting is for general education only; it is not trading advice.