Readers of my Better Spread Betting, Position Trading and Stop Orders books will know that I am inclined to try and pyramid profitable positions to higher stakes. For me, a necessary (but not sufficient) condition for pyramiding is that the potential loss on my second position is less than the profit accrued on my original position — so that I am assured to exit with some profit. Here is an example of what I mean:

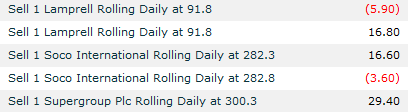

When my pyramiding of Soco International failed, I took a profit of £16.60 on my original position and a loss of £3.60 on my second (pyramided) position giving an overall net profit of £13 (minus any financing charges and a cost of guarantee).

The bottom line is that I only attempted those pyramids because a net profit was the expected outcome in any event.

(I hadn’t tried to pyramid Supergroup at all, so there was no second position to drag down my profit, but there was also no second position to benefit from any up-trend.)

Would you believe it? Just as I was about to post this article, another “failed” pyramid stopped out… but (of course) for a net profit:

Disclaimer: this posting is for general education only; it is not trading advice.