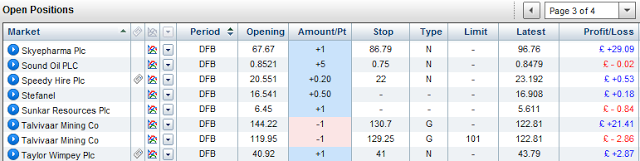

As someone who wrote an entire book on the subject of stop orders, it may come as no surprise that I do like to see those stops right alongside my open positions. Like this:

With my stop order on the G4S short position [list item #1] at slightly lower than the opening price, this position can’t exit for a loss… providing there is no price slippage.

With the stop order on my nicely profitable Talvivaara short position [list item #3] some 20 points below the opening price, I am assured (but not guaranteed) £20 of the current £29.50 “paper profit” if the price rises back up to meet my stop. If I wanted my locked-in profit or maximum loss to be guaranteed, then I would need to have applied a guaranteed stop order as I have on my more recent second (pyramided) Talvivaara short position [list item #2]. The “G” next to the stop order at 134.76 indicates that I am guaranteed to lose no more than £15.46 on this position, which compares favourably with the £20 profit that I am assured — but sadly not guaranteed — on the original position in the same stock.

The point of all this is that I can see the “risk” on each of my positions right alongside those positions, so that I can do the risk calculations while simply scrolling through the list and without having to click into those listed positions for more detail.

Not all spread betting companies show your stop orders (hence risk) right alongside your open positions. SpreadEx do so, and so do IG Index as you can see below.

Disclaimer: this posting is for general education only; it is not trading advice.