A few weeks ago at the beginning of August, Cape shares slumped by some 40%. I went in at my token £1-per-point (long), with a guaranteed stop order in place just in case the worst should happen (again) shortly afterwards. The worst didn’t happen, and in fact the best happened, with the share price up at around 230p-per-share this morning (30 August) relative to my buying price of 176.56 in an IG Index account.

I chose IG Index for this trade because they offer the widest range of individual equity markets, guaranteed stop orders (which right now I regard as essential), and the excellent DealThru charts.

When the Cape share price shot up this morning, I was a little disappointed to see that I couldn’t raise the guaranteed stop order that was sitting slightly below my buy-in price. This may be because the price moved so far so quickly; and as spread bettors we have to accept the fact that we won’t always be able to do exactly what we want when we want in fast moving markets.

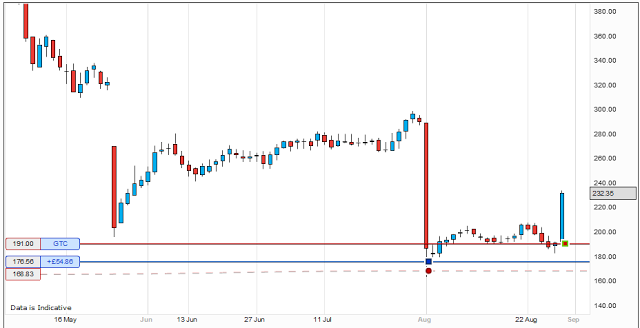

My solution to the problem of locking in some of the profit without actually closing the position and without the benefit of being able to trail my guaranteed stop order is as follows. I created an entirely new “opening” stop order that will sell short a position (thereby closing my existing position or at least hedging it with an opposing position) if the price falls to 191. As shown in the DealThru chart below, I now have my guaranteed safety net in place (dashed read line) slightly below my opening trade level (solid blue line) with my separate profit-taking stop order (solid red line) almost 15 points above my buy-in price.

Subscribe to Better Spread Betting by Email (I won’t tell anyone else, and you can cancel anytime)

Disclaimer: this posting is for general education only; it is not trading advice.