Note that I have titled this post An Example Trailed Stop Order rather than An Example Trailing Stop Order. The distinction for me is that I like to trail my stop orders manually myself (by periodically adjusting them) rather than by utilising (automatic) trailing stop orders.

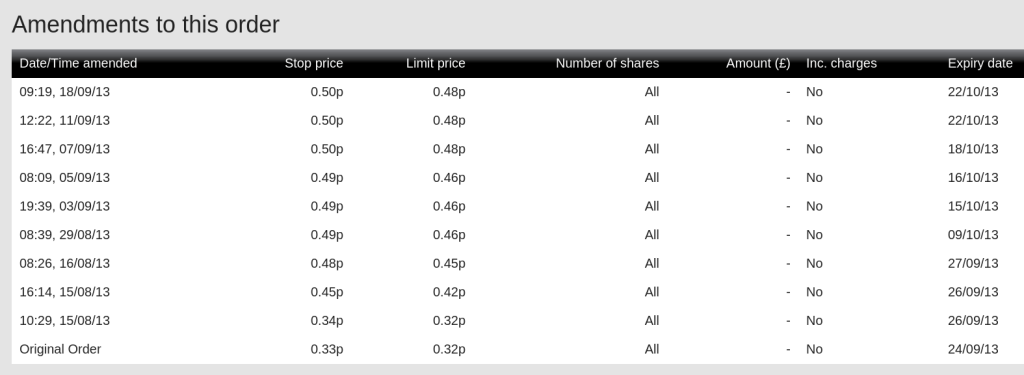

I thought long and hard about how I could best demonstrate a stop order than had been trailed manually over time, and then it occurred to me that the solution lay not in spread betting but in one of the regular stockbrokers that I use. They provide a handy facility showing the history of stop levels for the stop order placed on any particular stock. Here is the history of a stop order on eXpansys from the moment it was applied (at 0.33p) until the level at which it was triggered (at 0.48p):

Two things to note:

- Where the same stop level appears twice, it’s because I simply changed the expiry date of the stop order (because I like to keep them at the maximum of 30 days hence in this account).

- The Limit price is not a Limit Order in the spread betting sense, but at lower limit below which I would prefer the stop order not to be triggered at all (e.g. if the price gaps down).

I know this is not a spread betting example per se, but the idea of manually trailing a stop order is exactly the same.

Two Steps to Better Spread Betting:

1) Buy the Better Spread Betting Book

2) Sign up with Capital Spreads, IG, ETX Capital, or Spread Co

Disclaimer: this posting is for general education only; it is not trading advice.