After my little April Fool joke yesterday, I thought I’d post something rather more positive (and educational) today on the subject of pyramiding positions.

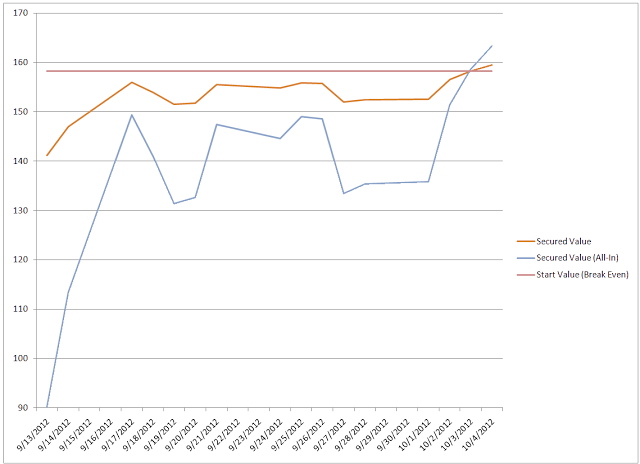

My demonstration vehicle will of course (if you’ve been following me) be Barratt; but it could have been Sainsburys. The following chart shows the vastly increased profit potential resulting from having pyramided the Barratt position — from £1-per-point to £2-per-point, then £3-per-point, then £4-per-point — at various points along the way.

My first observation is that while the “all-in” equity curve generates a higher profit sooner, this first-mover advantage decreases as time goes on when the effect of the pyramiding kicks in.

My second observation is that we’re looking at this through rose tinted spectacles and with the sure and certain knowledge that the Barratt share price only ever went up after the initial purchase. An initial purchase with a 4x stake would have given 4x the initial risk.

What is important to me is not only how much paper profit is generated, but how much of that value is “locked in” at any given point thanks to my guaranteed stop orders. The lines in the chart below indicate how much value was locked in during the life of this pyramid trade (higher wavy line) compared with the value that would have been locked in with the larger position size and no pyramiding (lower wavy line). You can see how much greater– and more volatile — the all-in-risk is in the run up being assured at least a “break-even” result thanks to the trailed stop order(s).

So the “start slowly and build up” pyramided trade was less risky in the early stages than the all-in trade, and in my book the managing of risk is more important than the pursuit of profit. Look after the downside, and let the upside take care of itself!

The final subtlety is that the more risk you take initially, the fewer diversified positions (across different stocks) you can take with the same amount of “risk capital”. Taking the “all-in” approach to its logical conclusion, why not go “all-in” with all your worldly worth in the first place on Barratt? Answer: because it could have turned out to be Northern Rock!!

You can find out more about the kind of pyramiding demonstrated here in the latest hot-off-the-press edition of my Position Trading book.

Two Steps to Better Spread Betting:

1) Buy the Better Spread Betting Book

2) Sign up with Capital Spreads, IG, ETX Capital, or Spread Co

Disclaimer: this posting is for general education only; it is not trading advice.