Today I noticed in one of my model “better spread betting” accounts that three positions in the same stock (Punch Taverns) had stopped out for modest profits, as shown here:

Although profitable, I don’t regard this as a good result. Not only because of the small amounts involved, but also because of the fact that I think this stock will yet go higher– so the stop-outs may have been a little premature. Still, profits are profits, and this trio of trades got me thinking…

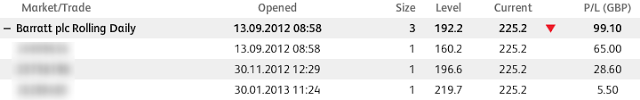

..that whenever I have talked about averaging down or (more likely) pyramiding up as features of position trading, I have used examples comprising only two steps. But as luck would have it, I had added a third position to a pyramided position trade the other day, with the net result as shown in the following Capital Spreads chart for Barratt.

The thin horizontal lines indicate the three entry prices, and the thick horizontal line indicates the common guaranteed stop order level (more or less). In a nutshell: whereas the third position may yet exit at a loss, this loss is eclipsed by the “locked in” profits on the other two positions. So just like in the case of Punch Taverns at the beginning of this posting, I am assured of an all-round profitable exit; and even more profitable in this case as indicated by the account snapshot below.

Now let me conclude by returning to my original example of Punch Taverns. Since I want to re-enter this stock, it’s disappointing that neither Capital Spreads nor InterTrader are currently allowing new positions in Punch Taverns to be entered. How nice, then, that ETX Capital and IG are both providing this equity for trading.

Two Steps to Better Spread Betting:

1) Buy the Better Spread Betting Book

2) Sign up with Capital Spreads, IG, ETX Capital, or Spread Co

Disclaimer: this posting is for general education only; it is not trading advice.