If you come from a traditional “investment” background, you will find one of the novel features of financial spread betting to be the fact that you can go short by selling shares (or indices, or commodities, or currencies) that you don’t own just as easily as you can go long by buying them. If you thought that a particular share price would fall, and if were operating in a regular stockbroker account, a self-select Individual Savings Account (ISA) or a Self-Invested Personal Pension (SIPP) the best you could do would be to sell your existing holding (if you had one) in the hope of sidestepping the downturn. But in a spread betting account, you could bet on the falling price simply by clicking the SELL button rather than the BUY button on your chosen stock’s trading ticket.

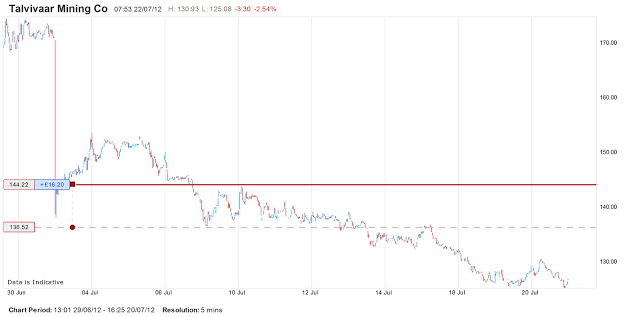

The Talvivaara Mining Company is an example of a stock that I recently shorted on the basis that the price would continue to fall after the price gap-down on 3 July 2012. In the following chart you can see that I sold the stock at a price of 144.22 and that three weeks later the price has fallen to 128.02 giving a “paper profit” of £16.20 on a nominal £1-per-point spread bet. More importantly, my manually-trailed guaranteed stop order — as indicated by the dashed line at 136.52 — assures that this trade is now guaranteed to exit with some profit if the price reverses upwards.

If you think that my £1-per-point short stake in this company was too small, do keep in mind that I often run these trades in multiple spread betting accounts; partly to spread my counter-party risk, and partly so that I can show the exact same trade in different contexts, like this:

If you want to see more real-life examples like this one as soon as they’re posted, don’t forget to…

Disclaimer: this posting is for general education only; it is not trading advice.